19 Terms

19 TermsHome > Industry/Domain > Accounting > Payroll

Payroll

Of or relating to the financial record of employees' salaries, wages, bonuses, net pay, and deductions.

Industry: Accounting

Add a new termContributors in Payroll

Payroll

Immigration Reform and Control Act of 1986 (IRCA)

Accounting; Payroll

Law enacted in 1986 that prohibits employers from hiring persons who are not authorized to work in the U.S. and from discriminating against those who are based on their national origin or ...

Illegal Immigration Reform and Immigrant Responsibility Act of 1996

Accounting; Payroll

Law enacted in 1996 that amends IRCA by reducing the number of documents that employers must accept to prove a new hire’s identity and work authorization.

Internal Revenue Service restructuring and Reform Act of 1998

Accounting; Payroll

Law enacted in 1998 to reform the governance structure of the IRS to make it more responsive to taxpayers and to promote electronic filing of information.

Form W-3c

Accounting; Payroll

Transmittal of Corrected Income and Tax Statements; form that accompanies Form W-2c in most situations when it is sent to the SSA that totals the information from all the W-2c forms being submitted.

Form W-3

Accounting; Payroll

Transmittal of Income and Tax Statements; form which an employer must also file when filing paper Forms W-2 (Copy A) with the SSA; contains totals of the amounts reported on the employer’s W-2 forms, ...

Form W-2

Accounting; Payroll

Wage and Tax Statement; employers must file a Form W-2 (to both the employee and the Social Security Administration) to report the total amount of wages paid and taxes withheld for each employee in a ...

Tax Reform Act of 1986 (TRA ’86)

Accounting; Payroll

Sweeping tax reform legislation that lowered tax rates and sought to eliminate many of the loopholes in the tax laws.

Featured blossaries

stanley soerianto

0

Terms

107

Blossaries

6

Followers

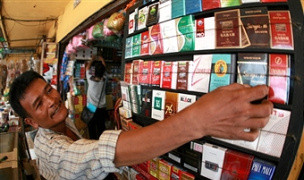

Cigarettes Brand

10 Terms

10 Terms