12 Terms

12 TermsHome > Industry/Domain > Financial services > Real estate investment

Real estate investment

Industry: Financial services

Add a new termContributors in Real estate investment

Real estate investment

adjusted basis

Financial services; Real estate investment

Basis is the cost of an asset or some substitute for cost. Adjusted basis is the basis, plus or minus certain adjustments such as expenditures, receipts, losses, and depreciation, I.R.C. § 1016.

asset depreciation range (ADR) system

Financial services; Real estate investment

The Asset Depreciation Range (ADR) System is a method of determining the allowance for depreciation by assessing the useful life of the property according to published guideline life ranges, I.R.C. § ...

after-tax investment

Financial services; Real estate investment

After-tax investment is the actual cost, after tax benefits, of the investment. It is often referred to as hard dollar investment.

alternative minimum tax

Financial services; Real estate investment

The alternative minimum tax is a tax that applies to taxpayers who otherwise would pay little or no tax because of the availability of various deductions and tax credits, I.R.C. § 55. The alternative ...

appraisal

Financial services; Real estate investment

An appraisal is a written valuation of property made by a qualified independent appraiser.

appreciation

Financial services; Real estate investment

Appreciation is the increase in value of real property due to various economic factors, such as inflation.

at-risk limitation on losses

Financial services; Real estate investment

If a taxpayer sustains losses in his business, there is a limitation on the amount of losses that he may deduct to amounts for which he is personally "at risk." The limitation is called the at-risk ...

Featured blossaries

stanley soerianto

0

Terms

107

Blossaries

6

Followers

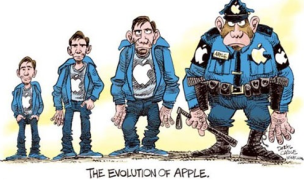

The Evolution of Apple Design

12 Terms

12 Terms